Should ESG be a Strategic Perspective?

by Stacey BarrIs it better to add ESG as its own strategic perspective, or use it to inform your strategic thinking?

ESG (environmental, social, and governance) performance has always been important, but only in recent years has it become top-of-mind for executives in all sectors around the world. But one of the struggles they have in taking it seriously is integrating ESG into their strategy:

“Roughly 70% of directors reported that they are only moderately or not at all effective at integrating ESG into company strategy and governance.” – Boston Consulting Group

Some of the easiest advice to find, to get ESG included in the strategic direction, is to add it as a perspective in the Balanced Scorecard.

Is ESG a logical perspective to add to your strategy map?

Robert S. Kaplan and Ricardo Reisen de Pinto demonstrated adding a “Social and Environmental” perspective between the “Learning and Growth” and “Internal Business Process” perspectives in the logic flow of the strategy map.

But doesn’t ESG performance overlap significantly with the classic perspectives of the Balanced Scorecard? It makes sense that:

- Environmental performance could be an important value of customers and could therefore lead to strategic objectives in the “Customer” perspective. It also relates very strongly to an organisation’s operations and could lead to strategic objectives in the “Internal Business Process” perspective.

- Social performance is clearly related to both perspectives concerning people and could therefore lead to strategic objectives in both the “Customer” and “Learning and Growth” perspectives.

- Governance performance includes financial transparency and could therefore lead to strategic objectives in the “Financial” perspective.

It’s also true that the classic Balanced Scorecard perspectives are too limiting to naturally accommodate other important dimensions of ESG. Some of these dimensions related to stakeholders other than customers or employees, data privacy, ethical behaviour, management compensation, and anti-corruption.

Retrofitting new ideas into old thinking frameworks just doesn’t feel right to me. Neither does bolting on each new idea as an adjunct to those frameworks.

ESG should inform strategy design, not bolt on to it.

The hardest part of strategy, arguably, is its design. Thinking is harder for most people to do than acting. So they rush to set goals and initiatives, rather than give the time required for deep strategic thinking. We see this all the time in the strategic plans of our clients:

- No obvious strategic analysis to support the selection of strategic themes or goals

- Lists of goals that sit under independent strategic themes

- Goals that are articulated vaguely enough to be often misunderstood or not understood

- Little or no cause-effect cascade of strategy into operations

When we get the leadership team together to review their strategy, which is always required in order to make it measurable, we have to talk more deeply about their strategy. We need to understand what they want to ultimately create. We need to understand what their strategic goals really mean. The most common reaction we get is this:

“This is the conversation I wish we’d had years ago.”

But the conversation needs to be even more than that.

It’s the strategic thinking and dialogue that we need to integrate ESG into. Not the boxes or categories or perspectives of the framework that will hold our strategic goals. And it’s not just ESG that should be integrated into that strategic thinking and dialogue. Think about all the other recent trends we’re encouraged to build into our strategy: diversity and inclusion, digital transformation, the ‘new normal’ after COVID.

ESG can be a theme running through strategy, without bolting on as another perspective.

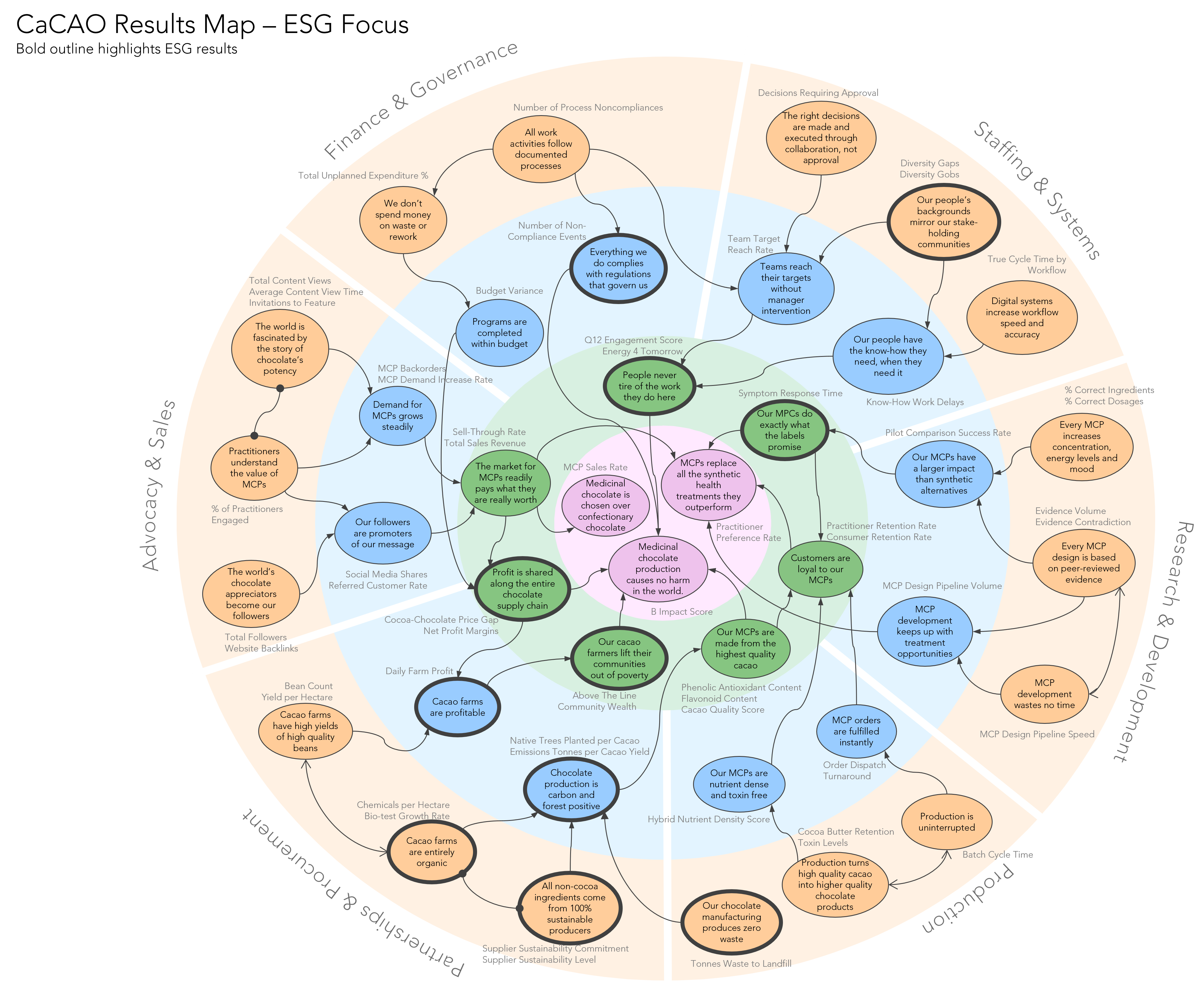

In a recent article about how to measure ESG performance, I shared a Results Map for a fictional organisation, CaCAO, that researches and manufactures medical chocolate products. This Results Map shows how a theme like ESG naturally integrates throughout a fully cascaded strategy:

[click to open a larger and easy to read version]

All of the results (or goals) in this map in bolder circles are part of the ESG theme. They didn’t need a separate ESG perspective or box to find their way into the strategic direction. It’s the strategic thinking that makes them a priority to include.

And when ESG informs the strategic thinking, it has a more logical and thorough integration with all the other strategic priorities too.

Connect with Stacey

Haven’t found what you’re looking for? Want more information? Fill out the form below and I’ll get in touch with you as soon as possible.

167 Eagle Street,

Brisbane Qld 4000,

Australia

ACN: 129953635

Director: Stacey Barr