Five Steps To Simple and Actionable Customer Surveys

by Stacey Barr |Most of us know we need feedback from customers in order to make service delivery and product design more in line with customer needs and expectations. But too often, our customer surveys fail to get truly focused and actionable data. Here is a simple approach that gives you punchy customer feedback, without overloading the customer with a thousand and one questions.

STEP 1: Know who your customers are

Gather all the relevant information you have to describe the relationship of each customer to your business or organisation, such as how much ‘business’ they give you, where they are located, what industry they are in, what their reasons are for using your services, and so on. The idea is to use this information to define market segments that group similar customers together, and help you organise your list of customers for selection into your survey sample.

For example, one of my clients was a general freight business, whose customers were everyday people who wanted to freight anything from furniture to clothes lines, from the coast to the outback.

STEP 2: Find out your customers’ needs

It’s your customers who define what ‘quality service’ means (not you!) and therefore you need to know your cusomters’ definitions of ‘quality service’ before you decide what you should be measuring in your customer survey. This means conducting a bit of qualitative research, like using focus groups, to ask your customers how they define their needs. Prioritise the top 8 to 12 of these customer-defined ‘service attributes’ as the starting point to creating your customer survey.

My freight business client’s customers cared about the care and handling of their freight, about getting quick access to their deliveries, and about the accuracy of the invoices sent to them.

STEP 3: Measure your customer service performance

Create a quantitative survey based around the 8 to 12 customer-defined service attributes from Step 2, so you can measure satisfaction levels with each one of them, along with their relative importance too. Don’t forget to include a question on the overall level of satisfaction customers have with your services. DO NOT assume you can calculate this by averaging the satisfaction with each of the service attributes.

Traditionally the freight business managers designed the questions in the customer survey: they added anything that seemed interesting to know. Surveys are impositions at the best of times, so we need to keep them short and sweet. Useful, not just interesting. So the new survey only asked questions about what customers said was relevant to them.

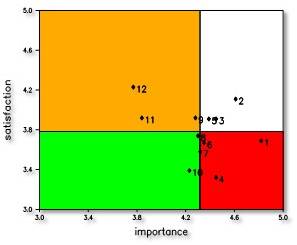

STEP 4: Focus on the customers’ priorities

Examining the average satisfaction ratings and average importance ratings for each of the service attributes will help you identify the priorities you need to act on. Don’t try and fix everything (aren’t you already complaining about how much you have to get through already?). Just focus on the service attributes that have the highest importance but the lowest satisfaction.

While the freight business managers believe that running on-time to their schedules was the highest priority, their customers didn’t agree. Their customers were most frustrated when they were asked to pay on invoices that were confusing and incorrect.

STEP 5: Fix your processes

Which of your business processes impacts most of the priority service attributes that need improvement? You’ll only get improvement if you fix those business processes (or at least improve them). You may even find it useful now to establish some internal measures (that is, not based on customer data) to track the processes’ impacts on those priority service attributes.

Clearly for the freight business, their invoicing process was a problem, producing inaccurate invoices as it was. They set up a new internal measure for % Invoices Unpaid Due to Errors and went about tackling the problems in the invoicing process that caused the inaccuracies.

Simple, but focused on priorities and clear action. That’s what all good customer surveys should be.

TAKE ACTION:

Do you have a customer survey now? How well does it reflect customer-defined priorities? How well is the data used to improve customer satisfaction? What can you do to make that customer survey simpler, more relevant and more actionable?

Connect with Stacey

Haven’t found what you’re looking for? Want more information? Fill out the form below and I’ll get in touch with you as soon as possible.

167 Eagle Street,

Brisbane Qld 4000,

Australia

ACN: 129953635

Director: Stacey Barr